- #Zoho invoice product limit software#

- #Zoho invoice product limit plus#

- #Zoho invoice product limit free#

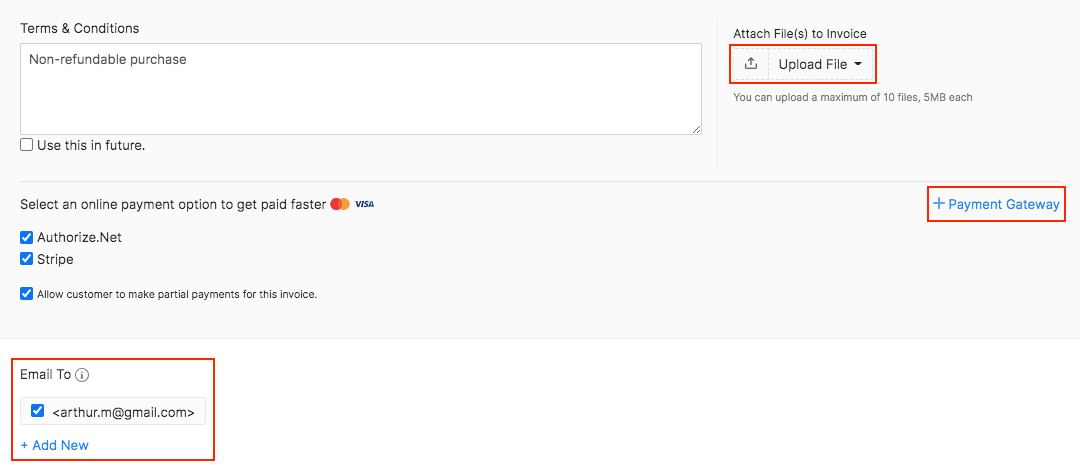

Thorough reporting features with simple accountant collaboration.Customizable purchase orders, easily convertible to bills.Online payment acceptance through Stripe, GoCardless and more.

#Zoho invoice product limit free#

Xero’s Established plan costs $70 per month.Įach Xero plan includes a 30-day free trial.Xero’s Growing plan costs $37 per month.Xero has three accounting plans for small and midsize businesses, making it a more scalable pick than Wave Accounting: Both providers also offer easy-to-customize invoices, though Xero’s cheapest plan limits users to sending just 20 invoices or quotes per month. Like Wave, Xero’s plans include unlimited users at no additional cost. Xero’s more comprehensive plans add project tracking, expense management and multi-currency support. Make most of your money selling products rather than services? Xero is the only accounting product on our list to offer inventory tracking with its cheapest plan.Īlong with inventory management, Xero’s users get bank reconciliation, cash-flow management, quotes, invoices and bill tracking - starting at the comparatively low monthly cost of $13 ($156 per year). Fewer third-party integrations than QuickBooks Online and Xero.įor a more in-depth look at FreshBooks’ features, pros and cons, read our FreshBooks review.Uncomplicated client collaboration through FreshBooks’ client portal.

#Zoho invoice product limit software#

Payroll integration with Gusto and SurePayroll.In-software tool for client communication and collaboration.Built-in time tracking, expense tracking and receipt capture.FreshBooks Premium starts at $55 per month or $594 per year.įreshBooks also offers a 30-day free trial.

#Zoho invoice product limit plus#

FreshBooks Plus starts at $30 per month or $324 per year.FreshBooks Lite starts at $17 per month or $183.60 per year.Customers who choose to pay annually lock in at least a 10% discount, though FreshBooks’ frequent discounts for both annual and monthly plans can run as deep as 70% off for six months.Īlong with its custom enterprise-level accounting plan, FreshBooks has three invoicing, accounting and billing plans for small and midsize businesses: FreshBooks’ pricingįreshBooks is the only accounting software product on this list to offer both annual and month-to-month payment options. FreshBooks’ cheapest plan doesn’t include double-entry accounting, and it doesn’t include free access for your accountant, either. (With the cheapest plan, the number is just five.) Additionally, Wave Accounting uses double-entry accounting, which is the best way to catch and fix accounting mistakes early on. While FreshBooks offers unlimited invoices, each plan limits the number of clients you can bill each month. Both software tools also have notably user-friendly invoice templates that are simple to customize. Both Wave and FreshBooks let you schedule automated recurring invoices, accept online payments through invoices and set up payment due date reminders. Like Wave, FreshBooks’ unlimited customizable invoices make it a great solution for freelancers with service-based businesses.

Whether you opt for Wave or an accounting alternative, you can safely assume it will offer online payment acceptance, financial reporting, mobile app access, customizable invoicing and basic financial tracking.įreshBooks: Best overall Wave alternative Wave and its six accounting competitors share the same basic bookkeeping features. Top Wave Accounting competitors and alternatives: Feature comparison table

0 kommentar(er)

0 kommentar(er)